Every sixth meme token on Base is fraudulent – a study.

Since the Dencun update, which lowered fees in L2 solutions, the Base protocol from Coinbase has seen a sharp increase in users, transactions, and TVL. Most of the activity involves meme coins, with one in six coins being a scam. This is stated in a report by Cointelegraph Magazine.

Researchers gathered the “profiles” of 1000 tokens launched from March 19 to 25. There are approximately 380,000 ERC-20 assets on Base in total.

The coins were analyzed by auto-auditors on the DEXTools analytics platform to determine their security. The tool examined locked liquidity, verified contracts, and the absence of “honeypots.”

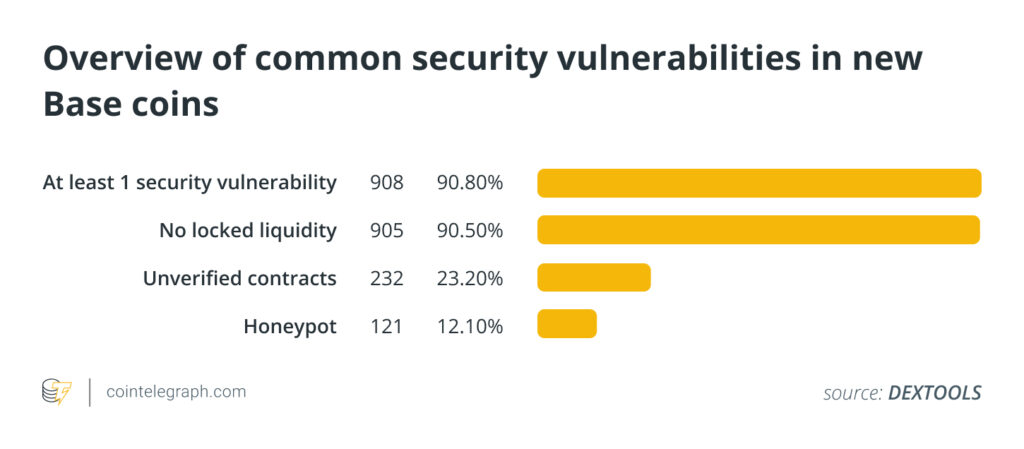

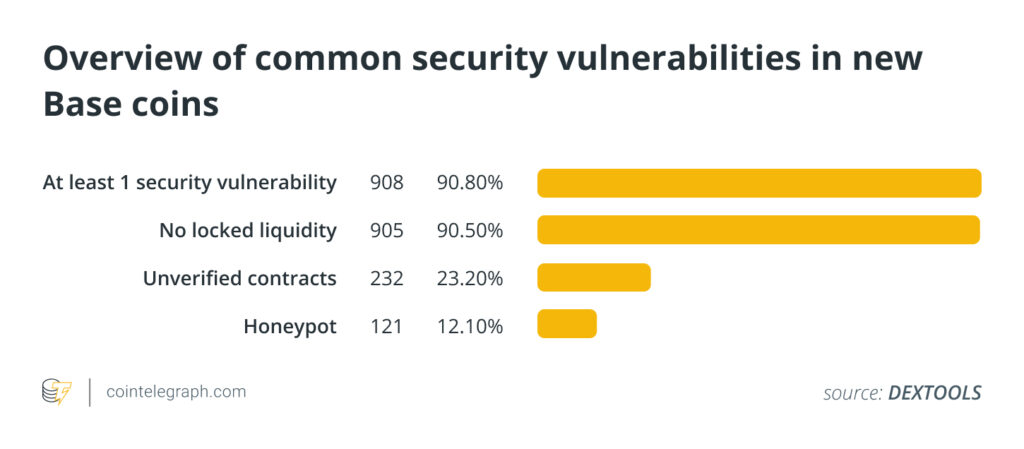

90.8% of tokens were found to have at least one security flaw, 90.5% did not have a locked liquidity pool (LP). Another 23.2% did not have a verified contract.

12.1% were “honeypot assets,” which can be bought but cannot be sold due to smart contract restrictions.

Although the data points to potential illegal activity, it also reflects a lack of knowledge among meme coin creators about security procedures, especially if they launched the token as a joke, according to the study.

“This scenario underscores the issues with projects that may not have the resources to hire security experts or conduct independent evaluations of their smart contracts,” noted David Schwed, COO of security firm Halborn.

Blatant Fraud

According to the analysis, 16.9% of projects are suspected of criminal intent due to inflated sales fees or deliberately fraudulent smart contracts.

Possible “honeypots” were found in 121 assets, with 48 coins having commission fees reaching 100%, which is practically indistinguishable from outright theft.

“Fraud with meme coins can take various forms, and automated auditors have a chance of incorrectly labeling tokens or even missing some inventive schemes,” noted Cointelegraph.

The most common vulnerability among the 1000 analyzed projects was found in their LP. 90.5% of projects did not lock their liquidity, making them prone to failure and potentially susceptible to rug pulls.

“A direct measure to counteract the risks of disappearing [developers] is to lock their liquidity pools. This action guarantees that they will not have access to assets. Sometimes these promises have an expiration date,” stated in the research.

However, the lack of liquidity locks does not always indicate malicious intent. Among the 905 projects without locking, 675 had verified contracts.

Real Utility

According to trading data provider Birdeye, around 1300 new tokens appeared on Base in the week leading up to March 25. Over the following seven days, their number increased to 4000.

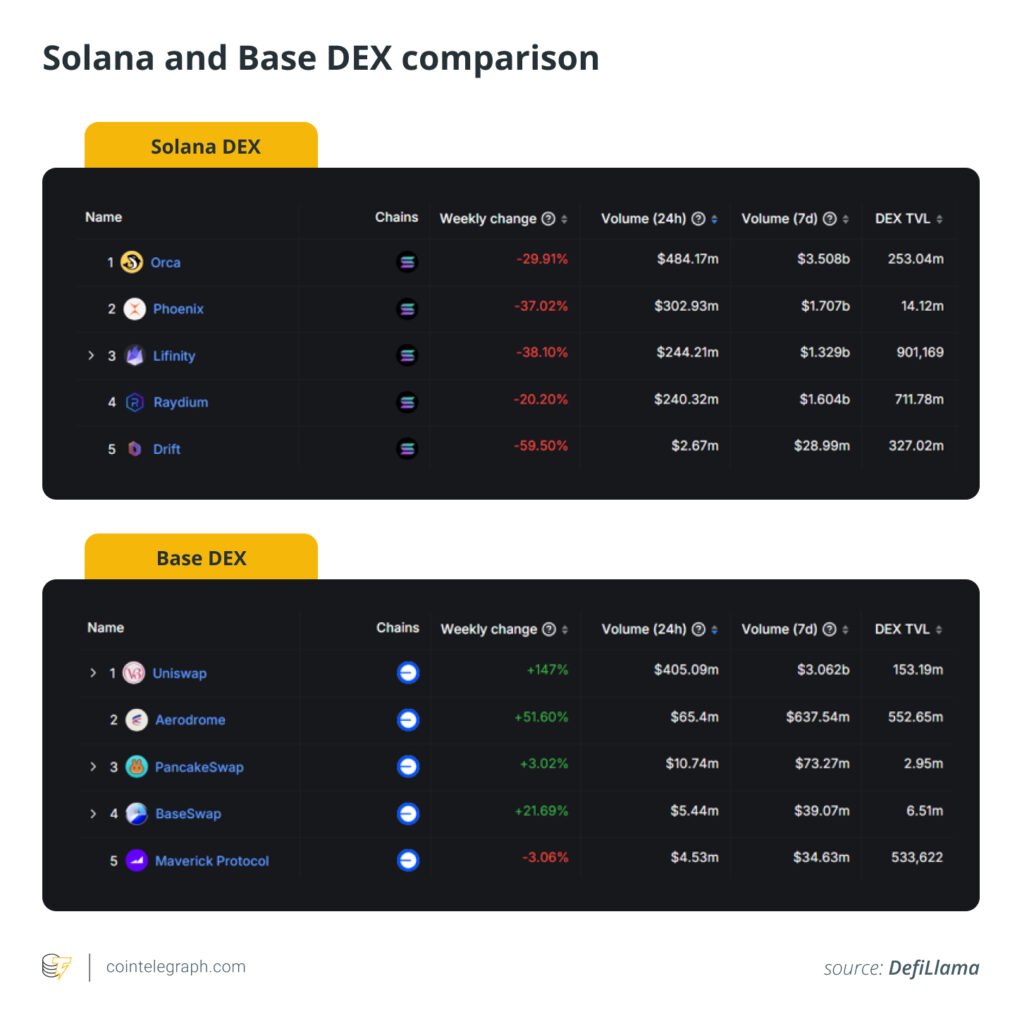

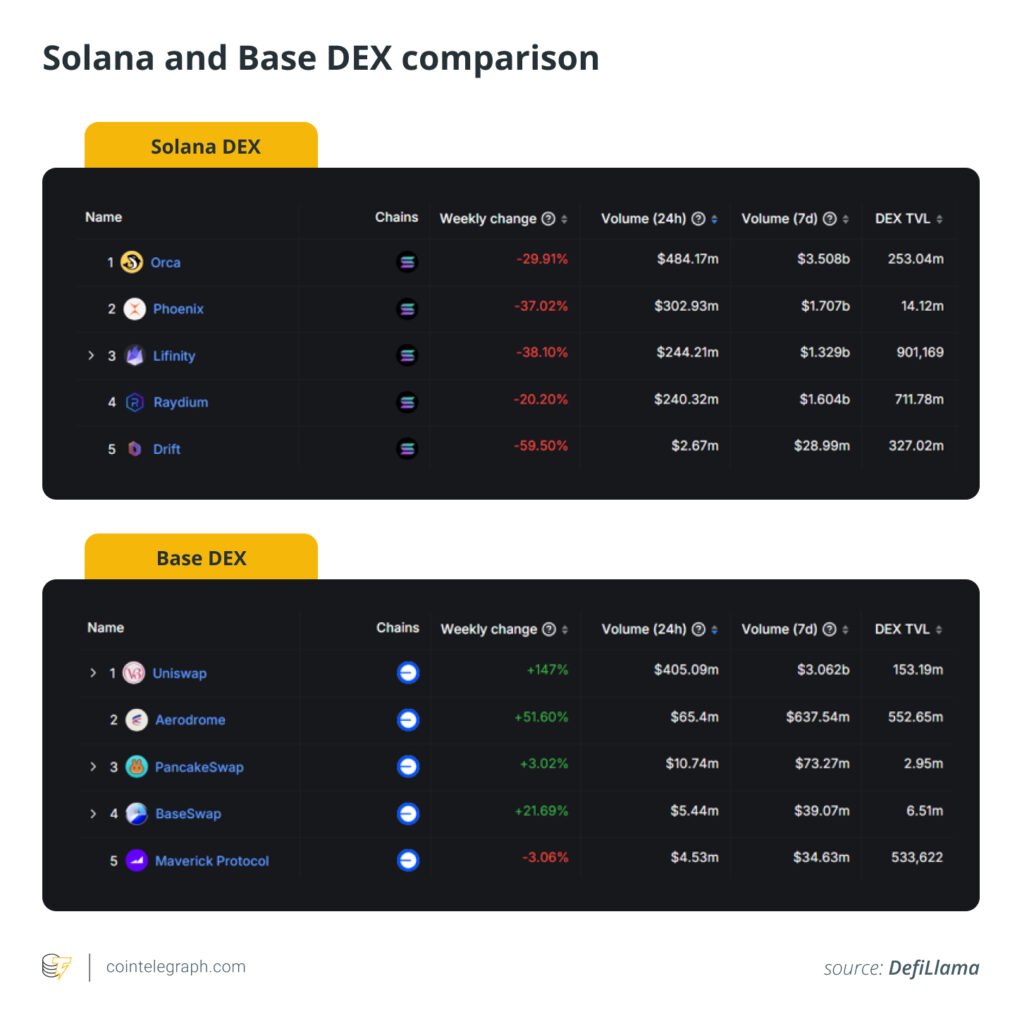

During this period, the weekly volume on the Solana network was around 19,000 coins. Based on this information, researchers noticed a shift of meme traders to decentralized exchanges (DEX) on Base.

From March 25 to April 2, trading volumes on the Solana DEX significantly decreased, with the top five platforms in the ecosystem experiencing a decline of 20-60%.

At the same time, four out of five decentralized exchanges on Base showed growth. The trading volume of the leading Uniswap increased by 147% to $405.09 million.

Earlier, some industry experts criticized the meme coin craze, fearing a bubble burst. CryptoQuant founder and CEO Ki Young Ju stated that such projects harm the crypto industry. He compared the situation to the ICO mania of 2018, which resulted in most investors losing their invested funds.

Messari’s Head of Research Martie Bass, on the other hand, believed that meme tokens play an important role in attracting new users to cryptocurrencies. The benefits of assets for the industry were also discussed by former BitMEX CEO Arthur Hayes and macro investor Raoul Pal.

On April 3, the URF meme coin team disappeared with 2400 SOL (~$450,000) collected during the coin’s presale.

Found a mistake in the text? Highlight it and press CTRL+ENTER

ForkLog newsletters: keep your hand on the pulse of the bitcoin industry!