Experts studied the impact of restaking on Ethereum metrics.

The emergence of the EigenLayer and LRT liquid staking protocols has increased the share of ETH in staking to 26% of the total supply. In Glassnode, they examined how this trend can impact the role of Ethereum as a monetary asset.

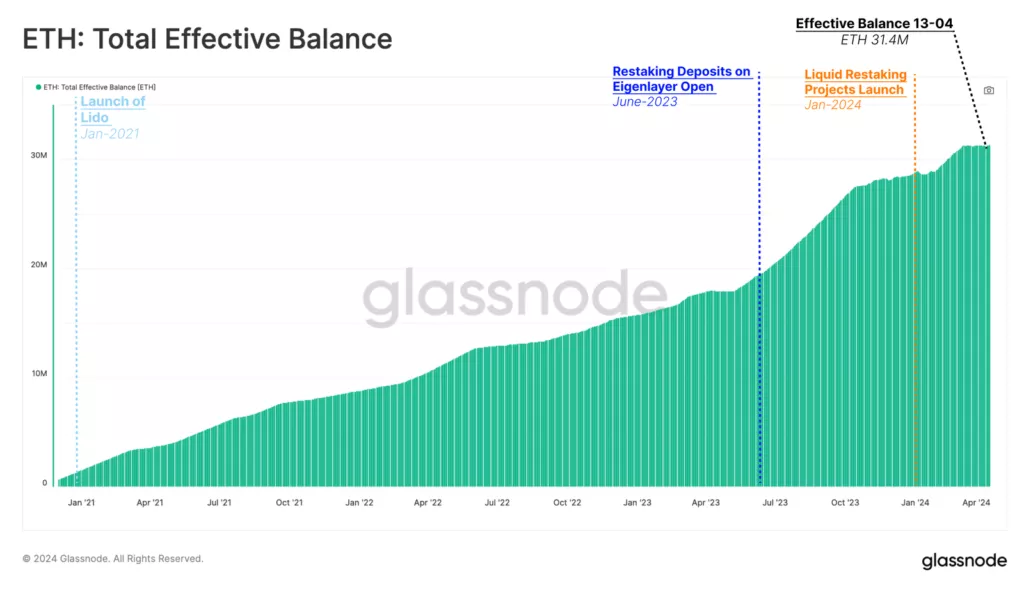

Analysts have noted an increase in the total number of coins in staking to 31.4 million ETH (as of April 13).

As a result of the metric increase, the reward level for network security per validator has dropped to 3.2% annually.

Innovations like MEV, liquid staking, staking, and liquid staking have led to increased demand in staking beyond the original intent, according to experts.

The share of liquid staking protocols currently accounts for 27% of coins deposited into the contract.

The TVL (Total Value Locked) of EigenLayer has increased to 14.2 million ETH (~$13 billion). The high demand for staking is also partly due to the anticipation of an airdrop, as noted by Glassnode.

More than 61.1% of this amount is in ETH. The rest is represented by LST (Liquid Staking Tokens) like stETH from Lido (21.6% of the total TVL of the project).

According to DeFiLlama, the total value locked in EigenLayer assets (TVL) is $12.6 billion, while in Lido it is $29.06 billion. These projects rank second and first, respectively.

63% of assets deposited into EigenLayer were directed from LRT projects.

Researchers at the Ethereum Foundation have expressed concern about the pace of coin growth in staking.

Despite the fact that a larger amount of ETH leads to a decrease in rewards for non-validator security, the overall amount of rewards paid out can still contribute to inflation, given a significant number of locked assets.

After The Merge, the share of new coins in the total Ethereum supply reached 1.01%. During this period, around 3.55% of ETH was removed from circulation.

As ETH in staking increases, the impact of inflation begins to affect fewer holders of the asset. In other words, wealth is transferred to participants who generate additional returns from network security maintenance.

Over time, this component of “real yields” can make owning ETH less attractive and nullify Ethereum’s function as a monetary asset in the Ethereum ecosystem, experts noted.

Instead, the role of “money” may shift to LST tokens like stETH or even to LRT as a high-yield instrument. The side effect will be the excessive influence of such projects on consensus and execution levels in Ethereum.

By now, more than half of the ETH in staking is associated with LST (42.3%) and LRT (8.3%).

The Ethereum Foundation proposed limiting and containing the annual issuance to reduce the influx of new staking participants. The community criticized this initiative, experts pointed out.

Experts recalled that Dencun set a fixed limit for new validators (eight every epoch in 6.4 minutes) to slow down their growth rate.

Prior to the update, the number of validator entries/exits from the staking pool was regulated by the outflow limit. This innovation is another step towards specifying the pace of increasing the total number of active validators. This will help reduce the side effect of deteriorating interaction latency between nodes.

On April 10, developers launched EigenLayer and its EigenDA data availability level (in beta) on the Ethereum mainnet.

Found a mistake in the text? Highlight it and press CTRL+ENTER

ForkLog newsletters: stay in touch with the Bitcoin industry!