At Bitfinex, they pointed out the repetition of the “2020 pattern” before the sharp rise in Bitcoin.

A significant reduction in the inactive supply of the first cryptocurrency, the structure of which has been changing for over a year, indicates the withdrawal of the asset from exchanges or selling by long-term holders. This is stated in the report by Bitfinex.

Current actions of Bitcoin investors mirror the pattern observed in December 2020 before the sharp rise in the crypto market, analysts pointed out.

“This model suggests that we may be entering a similar growth phase,” the experts added.

According to analysts, after recent large liquidations related to Bitcoin’s decline, funding rates have started to recover. Traders’ attention has shifted to the halving.

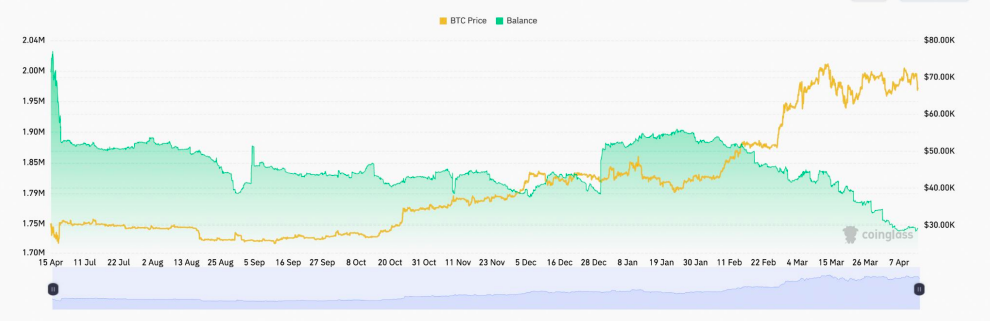

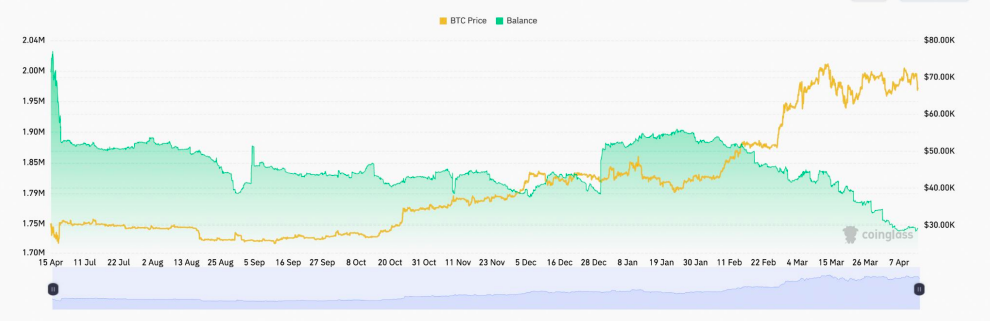

According to the report, a fundamental factor in price dynamics will be the halving of the block reward, which as it approaches has also led to a significant volume of Bitcoin being withdrawn from centralized exchanges. The indicator dropped to a 2021 low of ~1.75 million BTC.

Co-founder of Swarm Markets Timo Lehesa, in a conversation with The Block, added that caution is now needed, as the reduction in miner rewards could have a mixed impact on the market.

“There is still potential for price dispersion, especially considering geopolitical instability, which unexpectedly led to price declines in the short term,” he specified.

At the time of writing, digital gold is trading at $62,400, down 2.9% over the past day.

Earlier, MN Trading founder Michaël van de Poppe suggested that Bitcoin’s quotes had started moving towards a maximum above $73,000.

Recall that former BitMEX CEO Arthur Hayes predicted a possible decline in Bitcoin ahead of the halving. The reduction in block rewards acts as a price catalyst in the medium term, and during the specified period, the coin will face liquidity outflows, according to the expert.

Found a mistake in the text? Highlight it and press CTRL+ENTER

ForkLog newsletters: keep your finger on the pulse of the Bitcoin industry!