“Halving” from Grayscale: Bitcoin fund lost half of its assets.

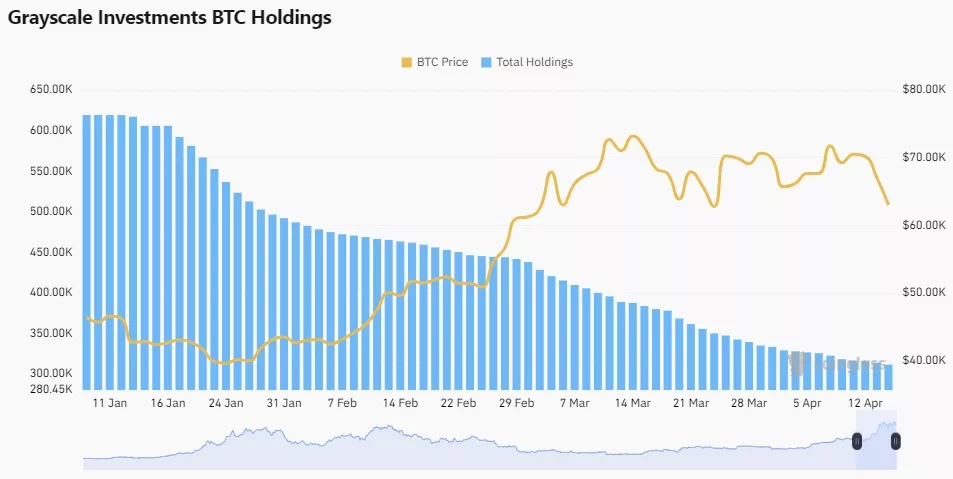

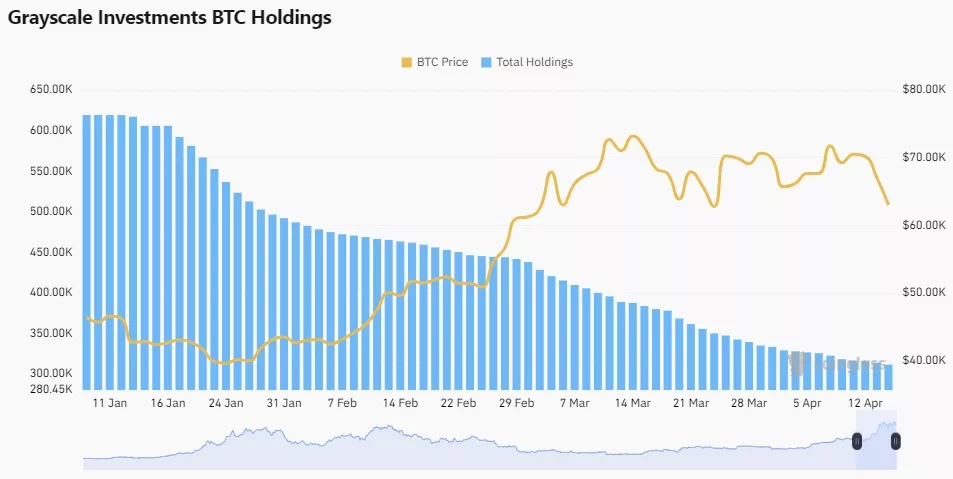

Crypto Assets of the Grayscale Bitcoin Trust ETF GBTC from Grayscale Investments have nearly halved in about three months after converting into a spot ETF.

Unlike other issuers like BlackRock or Fidelity, the company’s investment structure started on the New York Stock Exchange, operating with about 619,220 BTC.

According to Coinglass, the amount of cryptocurrency available to GBTC as of April 16 has decreased to ~311,620 BTC.

Thanks to the rise in the price of bitcoin since the beginning of the year, the value of assets under management (AUM) decreased by only ~31% – from $28.7 billion to $19.6 billion.

The spot Bitcoin ETF from BlackRock approached the leader with a figure of $17.2 billion.

Both products were the only ones to record any movement of funds on April 15. The trends turned out to be opposite. Despite Grayscale CEO Michael Sonnenshain’s recent statement about the stabilization of outflows from GBTC, the fund continued to see withdrawals.

Before the launch of spot Bitcoin ETFs in the US, experts pointed out the management fee size at Grayscale – 1.5%. Most competitors like BlackRock maintain a rate of 0.25%. However, many had a discount system in place at the initial stage.

“It’s no surprise that all new issuers entering the market here, in the US, are engaging in a concessions race. They all start from scratch and hope to attract assets from investors,” Sonnenshain commented at the time.

Recall, the head of Grayscale predicted the collapse of most Bitcoin ETFs. In his opinion, “two or three exchange-traded funds” will remain in the segment.

Found a mistake in the text? Highlight it and press CTRL+ENTER

ForkLog newsletters: keep up with the pulse of the bitcoin industry!