Miners have started hunting for the first “epic” Satoshi after the halving.

Bitcoin mining companies will try to mine the first block that appears after the halving to receive an “epic” satoshi with an estimated value of several million dollars. This was reported by CoinDesk.

What’s the Value?

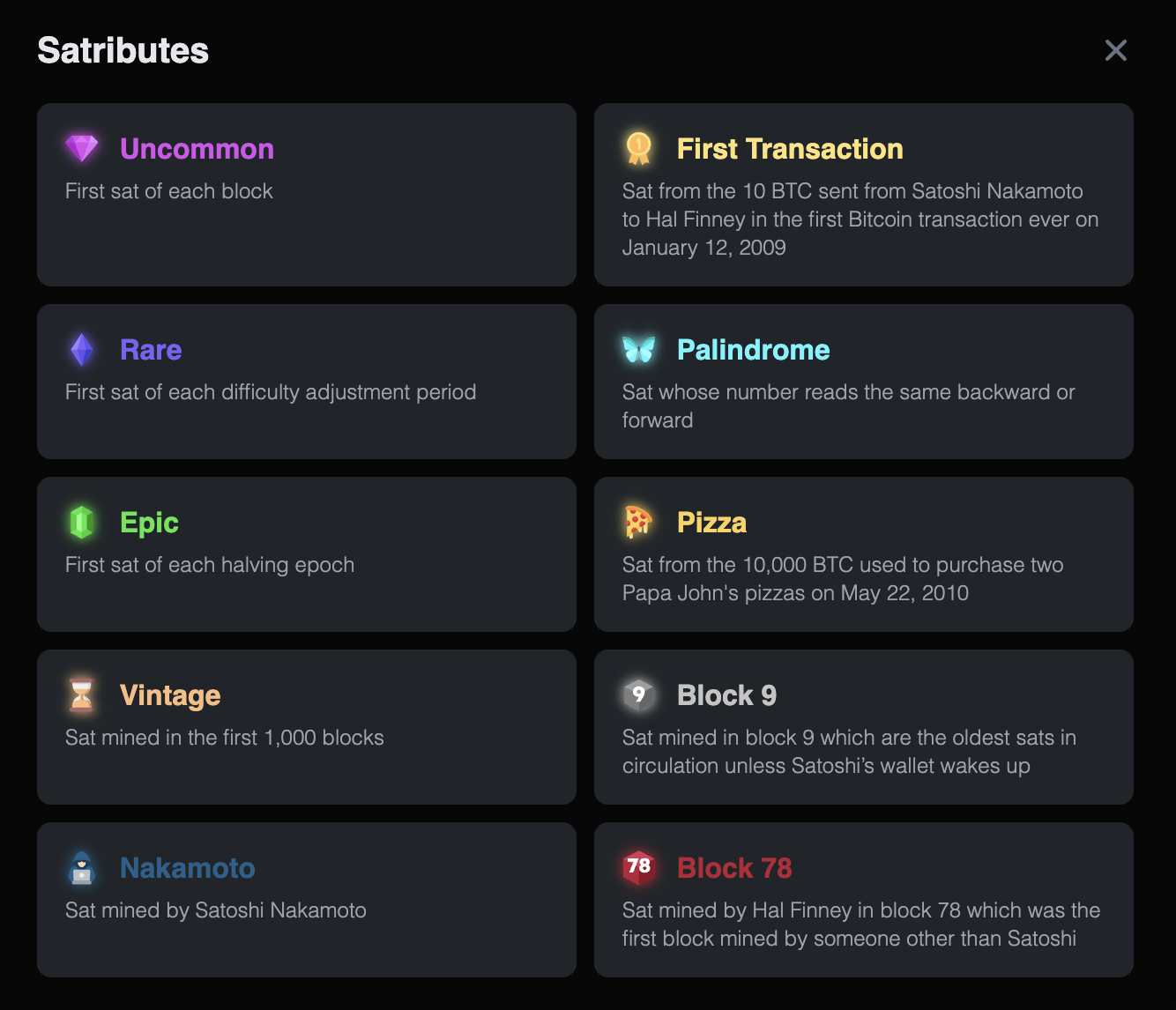

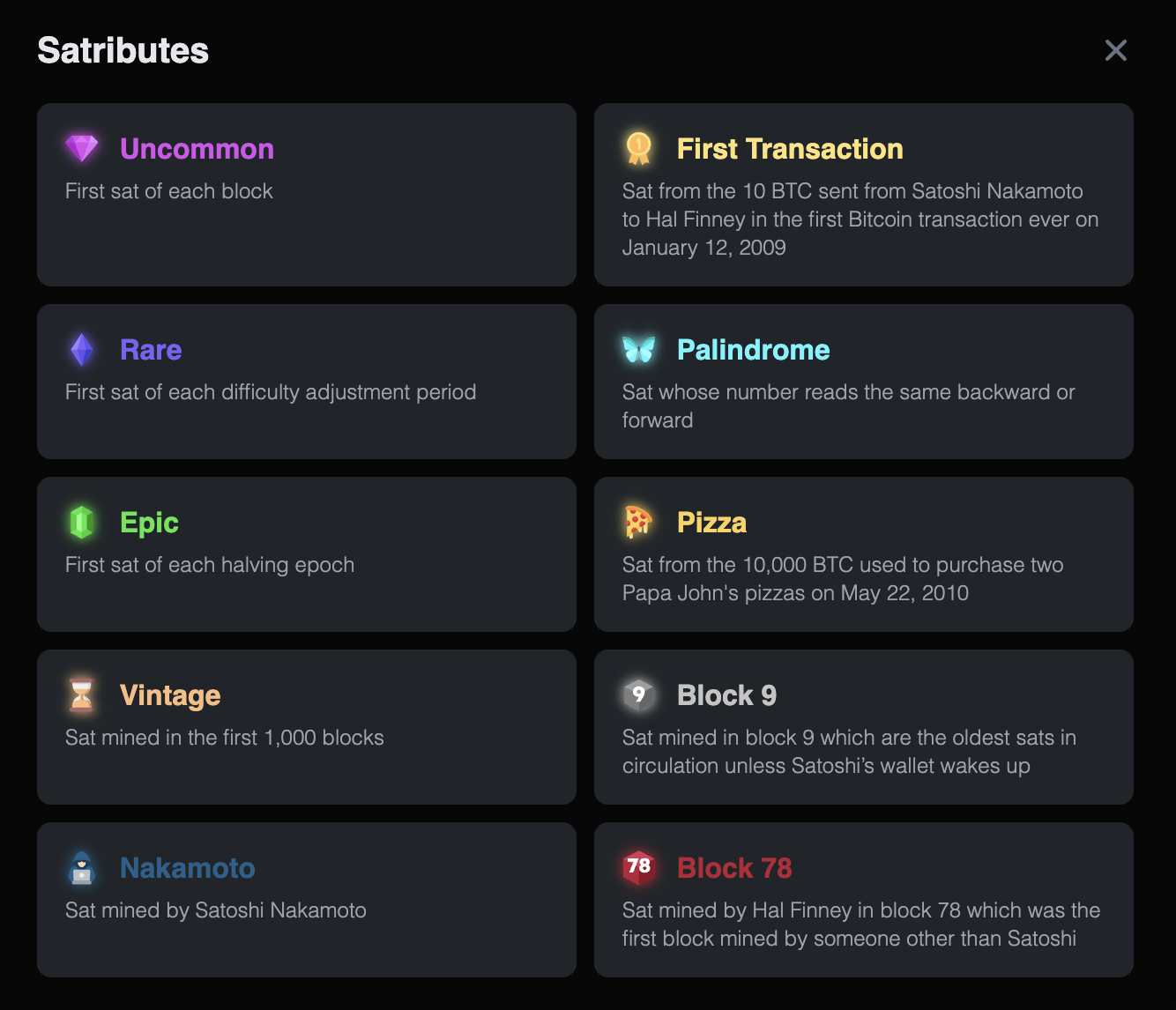

Approximately two years ago, the creator of the Ordinals blockchain-based protocol for the first cryptocurrency, Casey Rodarmor, developed a system for classifying the rarity of individual sats.

With the introduction of “marks,” it became possible to number and sell fractions of bitcoin similar to non-fungible tokens. Rodarmor’s scale ranged from the first “unusual” satoshi in each block to the “mythical” one – the very first in blockchain history.

One of the highest levels of rarity is occupied by the “epic” sat, mined in the first block of Bitcoin after each halving.

Founder of Ordiscan under the name Tristan suggested that Ordinals collectors could “conservatively” assess this asset at $50 million.

“If we compare the amount of satoshis received during the event that occurs every two weeks [difficulty adjustment] with the amount of satoshis received once every four years, I don’t know how much they will be worth, but this value can reach millions of dollars,” said Adam Svek, Director of Mining Development at Marathon Digital.

Hashrate Race

According to CoinDesk, mining companies could coordinate their capacities to mine the rare satoshi before the halving itself, which is expected to take place on April 20 at block height #840,000.

The network participant who mines the coveted block must send 546 satoshis – the minimum transaction amount called “dust limit” – from a portion of the reward of 3,125 BTC to a cold wallet. After that, the sat in the mempool will be marked as the “back number” as the first in the epoch.

“Essentially, they split 3,125 BTC into two parts: one of them is incredibly small, and it contains the first satoshi, and the rest is just bitcoin, and there is nothing special in it,” explained Tyler Whittle, a representative of Ordinals Taproot Wizards.

According to Svek from Marathon, the company has “thousands of such unusual satoshis”, including the first in the block. The firm has often studied the market to understand the value of such assets.

Marathon also mined the first sat after a difficulty adjustment, which at one point “was worth hundreds of thousands of dollars.”

Miner Hut 8 is examining its balance for rare resources that it may already own.

“When we first started mining, people said they would pay a premium for initial bitcoins, but it’s not a very liquid market, so the price is not very clear here,” noted company CEO Asher Genut.

Large miners with high hashrates could well contend for the “epic” satoshi. For example, Marathon’s share is about 5%, indicating that the company has a corresponding chance of receiving the first satoshi after the halving.

“We understand that this is a kind of lottery ticket. But we try to make sure that all our devices are connected to the network. This is our goal in any case, and we are keenly aware of the approaching halving,” added Svek.

CEO of Argo Blockchain Thomas Chippas noted that miners can only compete for the desired satoshi if they have comparable capabilities to Marathon.

It was previously warned by 10x Research about a potential $5 billion Bitcoin sell-off by miners after the halving.

In April, Marathon CEO Fred Thiel stated that the upcoming block reward reduction has already been factored into the price of bitcoin.

Found a mistake in the text? Highlight it and press CTRL+ENTER

ForkLog newsletters: stay up to date with the bitcoin industry!