The experts provided the rationale for stress testing USDe from Ethena.

- Against the backdrop of a bear market, rewards from derivatives shorts may not be enough to maintain the stability of the USDe exchange rate.

- Questions arise about the level of diversification of centralized partners.

- The growth of the capitalization of the “synthetic dollar” may limit the capacity of the crypto derivatives market.

To gain trust in USDe from Ethena Labs, it is necessary to demonstrate stability in unfavorable market conditions. Experts presented conditions for such stress testing to Cointelegraph.

The capitalization of the CDP-stablecoin from Ethena Labs exceeded $2 billion faster than any other similar asset in the history of cryptocurrencies.

The rapid rise and attractive yield of 17.2% p.a. have raised concerns that USDe may repeat the spectacular collapses of similar projects.

Unlike the notorious UST from Terra, the architecture of Ethena’s stablecoin is based on the popular TradFi strategy of delta-neutral trading and portfolio management. It is often used in the options market to control risks associated with changes in the price of the underlying asset.

Users deposit Bitcoin, Ethereum, stETH, or USDT into the protocol to issue USDe. Collateral assets are used to open equivalent short positions in perpetual contracts.

According to Keyrock representative Justin d’Anetan, the delta-neutral trading strategy has been proven over decades as a form of Cash-and-Carry trading in TradFi. It is considered safe under favorable market conditions.

Risk of Negative Financing Rates

Amid the cryptocurrency market rally, fewer investors are willing to take the risk of falling prices. As a result, Ethena can provide returns on USDe by receiving rewards from long holders in the form of financing rates.

In a bear market, the situation will change – the issuer will have to pay financing rates to long position holders.

“Shorts [become] expensive to maintain, which could potentially lead to depegging if expenses exceed manageable levels,” explained Aqua Protocol co-founder on the TON network, Yulia Palamarchuk.

Ethena can pay commissions using income in stETH from staking. The token accounts for 16% of the collateral assets, according to the project’s website.

Currently, stETH yields 3.3% annually, which may not be enough to cover obligations during sustained negative financing rates, noted in the publication.

During a period of heightened geopolitical risks in the Middle East on April 13, financing rates became sharply negative. Against this backdrop, USDe briefly deviated from its peg to $0.995.

According to Ethena’s Head of Growth, Seraphim Checker, the “synthetic dollar” passed its first stress test.

The team does not expect prolonged periods of negative financing rates to occur too frequently.

In February, Ethena founder Guy Young stated based on internal analysis that in 2022, in a bear market, the average financing rate was zero. The worst periods included a metric close to -3% for a week.

“When the interest rate is too low, the market signals that the supply of USDe is too large compared to the system’s needs. This means we need to reduce it,” explained the entrepreneur.

The Invisible Hand also plays a role in maintaining the peg of the “synthetic dollar” during market collapses. To protect their interests, users must redeem their USDe, leading to a reduction in shorts, contributing to the restoration of financing rates.

“There is no situation with zero risk in any TradFi market, and certainly not in DeFi. Ethena’s strategy makes sense and should guarantee stability alongside profitability. The latter will depend on how in demand derivatives are. Therefore, it may not remain as high as it is now, but should not create serious problems,” noted d’Anetan.

Risks of Centralized Counterparties

In recent years, some platforms have imposed restrictions on fund withdrawals or become insolvent, so USDe’s dependence on CEX raises serious concerns.

The team partially reduces this risk by involving off-exchange custodians. The latter hold Ethena investors’ cryptocurrencies and use them to open positions in perpetual contracts on behalf of clients.

If a centralized platform faces insolvency or other risks, the project’s derivatives position will be closed, but the collateral assets will remain safe, as they were never on exchanges in the first place.

At the same time, the risk of depegging USDe will remain if the perpetual contract position is not transferred to another platform.

“Ethena’s current centralized operational model, including custodial wallets for fund management, creates significant security risks and contradicts DeFi’s decentralized ethos,” explained Palamarchuk.

According to observations by South Korean University Hansung Jaew Cho, a significant portion of wETH from Ethena has gone directly to Bybit, and USDT to Copper.

“This gives the impression that the risk is not very well diversified,” commented the specialist.

According to Ethena’s data: Copper holds $1.28 billion of the project’s collateral assets, Ceffu – $1.07 billion, and Cobo – $4.87 million.

Ethena’s Derivatives Model May Limit Supply

USDe is unlikely to catch up in capitalization with centralized analogs like USDT.

“The derivatives market size and limits on maximum open interest on exchanges may limit the asset’s growth potential,” explained Palamarchuk.

The growing capitalization of USDe increases the volume of short positions in derivatives, pushing up negative financing rates. Theoretically, such a decrease in profit motive prompts investors to close shorts and liquidate the “synthetic dollar.”

If USDe’s volume becomes too large for long positions to stabilize financing rates, the asset’s expansion may be limited.

As of April 11, the Open Interest (OI) in Ethereum contracts was estimated at $9.75 billion. 12% of this value was related to positions connected to the issuer.

The project addresses scalability issues by expanding collateral assets, recently adding Bitcoin. OI for gold-backed contracts is $37 billion.

CryptoQuant CEO Ki Young Ju expressed concerns about the risks for Bitcoin posed by including the asset as collateral for USDe. The expert drew parallels with the collapse of the Terra token (LUNA) and its associated algorithmic stablecoin UST.

Unlike stETH, Bitcoin does not generate staking income. Neither does USDT or ETH.

This means that the safety cushion that can mitigate the impact of negative financing rates will be smaller compared to other collateral assets like stETH.

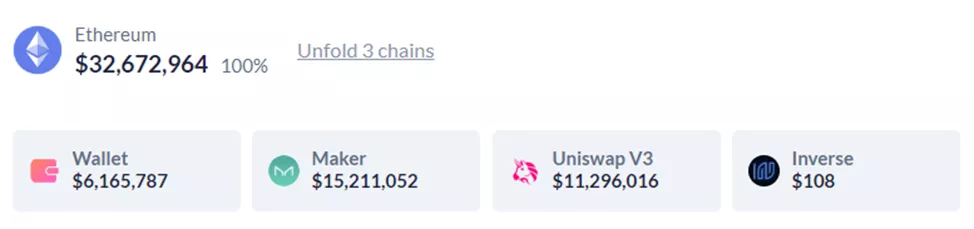

As a result, there may be a need for the team to use the insurance fund. Currently, the fund holds cryptocurrencies worth $32.7 million.

Notably, Ethena holds $15.2 million sDAI in Maker and $11.3 million in USDe and USDT pairs on Uniswap. Another $5.1 million is in USDT and $1 million is in USDe.

The reserve is mainly formed through excess income from derivatives, which are considered redundant since USDe holders prefer to hold the asset rather than stake it for rewards.

“In a scenario where Ethena uses DAI in its insurance fund, and Ethena and MakerDAO face market downturns, interdependence could indeed pose risks,” pointed out Palamarchuk.

There is also a hypothetical threat from the deviation of stETH from ETH, although such a scenario seems unlikely.

As a newcomer to the market, Ethena must carry the heavy baggage of past failures with stablecoins. However, experts claim that the likelihood of depegging is not so great.

“Aside from operational mishaps or execution errors, the trading itself is virtually risk-free,” stated d’Anetan.

In conclusion, the specialist added that users must balance custodial risks and market conditions with the “convenience and attractiveness” of the stablecoin and its yield.

In April, Ethena Labs increased rewards for those who have locked a large amount of ENA in staking.

Found a mistake in the text? Highlight it and press CTRL+ENTER

ForkLog newsletters: stay on top of the bitcoin industry!