Experts explained the impact of the halving on altcoins.

Altcoins will react differently to the reduction of rewards for Bitcoin miners depending on various factors, including tokenomics, value proposition, and overall contribution to decentralization. Several experts stated this in a conversation with Cointelegraph.

Preparing for the Event

Historically, it has been observed that after halving, Bitcoin experiences exponential growth, followed by the entire crypto market.

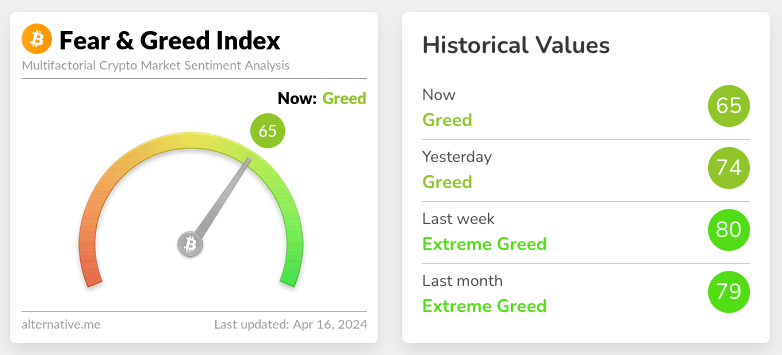

Over the past year, digital gold has grown by 110%, and investors expect the rally to continue. This is indicated by the cryptocurrency fear and greed index, which currently stands at 65.

The BNB Chain development team stated that the halving is known for its impact on the sentiment of the Web3 ecosystem. According to them, projects with a strong foundation and innovative technologies attract more investor attention during this period.

“On our part, we see more initiatives aimed at fostering ecosystem growth and innovation,” the team added.

Co-founder and CEO of Aptos Labs, Mo Sheikh, noted a growing interest in Web3 against the backdrop of the halving reward reduction.

CEO of the crypto exchange M2, Stefan Kimmel, emphasized the need for “right updates” for projects that align with the halving narrative.

“Looking at the bigger picture, the halving captures attention, but we understand that it is just part of a broader story. The emergence of ETFs, quantitative easing, and halving will define the future contours of the market,” he believes.

Altcoin Movement

BNB Chain highlighted the correlation between Bitcoin halving and the rise of altcoins. The reward reduction and changes in Bitcoin’s mining difficulty indirectly affect the profitability of mining other coins, influencing market participants’ behavior and prices.

Investors seeking higher returns often reallocate some of their bitcoins into various altcoins after halving, experts emphasized.

At the same time, projects aim to increase the amount of the first cryptocurrency in securing their asset to minimize volatility.

“Altcoins with strong use cases, supportive communities, and promising growth prospects can attract a portion of Bitcoin reserves, enhancing liquidity and trading volume in the ecosystem,” representatives of BNB Chain explained.

Despite the market revival during halving, the event sometimes creates certain problems that divide altcoin ecosystems.

Differences in economic incentives for miners, stakers, and other network participants, combined with community disagreements, often lead to soft forks and hard forks.

If Core doesn’t accept your code, fork Core and get people to run your fork. For instance, I just released Libre Relay on top of Bitcoin Core v27.0rc1:https://t.co/id22qRZMUG

Of course, I have a much easier time doing this because I’m not trying to censor anyone… https://t.co/jx5p9mdnMx pic.twitter.com/bI4AL2Lsen

— Peter Todd/mempoolfullrbf=1 (@peterktodd) April 11, 2024

“If [the] Bitcoin Core team does not accept your code, create a fork and ask people to run it. For example, I just released Libre Relay on top of Bitcoin Core v27.0rc1,” wrote Bitcoin developer Peter Todd.

These changes can create new cryptocurrencies with modified protocols designed to meet the needs and preferences of specific factions within the community.

However, such solutions are not always successful. The Ethereum Classic (ETC) hard fork with the Proof-of-Work consensus mechanism shows rather weak dynamics. According to CoinGecko, ETC has only grown by 19% over the past year.

Recall that in March, Bitfinex analysts pointed out the strength of altcoins and the weakness of Ethereum.

Found an error in the text? Highlight it and press CTRL+ENTER

ForkLog newsletters: keep your hand on the pulse of the Bitcoin industry!