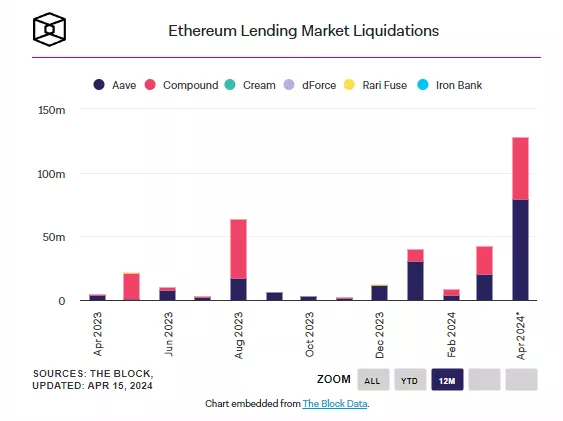

The liquidations in ETH lending protocols exceed $127 million.

During the first two weeks of April, the volume of liquidated positions in the Ethereum lending markets reached $127.8 million, exceeding monthly values at least since June 2022. This data is provided by The Block.

The dramatic events in the summer of 2022 were dictated by investors’ reaction to the crash of Terra.

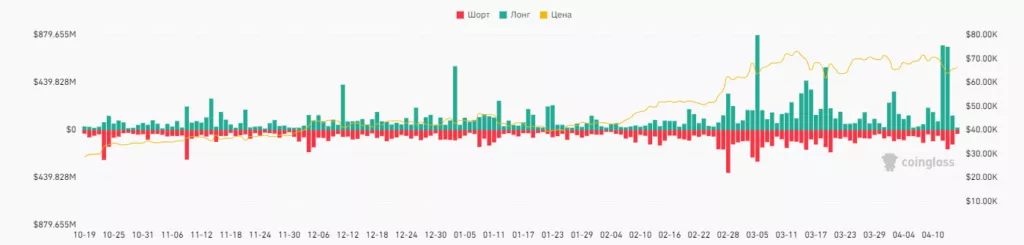

The spike in the indicator was triggered by the cryptocurrency price crash on April 12-13.

The majority of liquidations are attributed to the Aave protocol ($79.4 million) and Compound (~$48.3 million).

The price crash of Curve (CRV) also threatened the liquidation of a loan by project founder Mikhail Yegorov. The entrepreneur managed to avoid the negative scenario. He stated his intention to reduce his risks, according to The Block.

According to Coinglass, the volume of liquidations in the cryptocurrency derivatives market on April 12-14 amounted to nearly $2.1 billion.

Former BitMEX CEO Arthur Hayes predicted the decline of Bitcoin before and after the halving. He called the event a bullish catalyst for the market in the medium term.

Found a mistake in the text? Highlight it and press CTRL+ENTER

ForkLog newsletters: keep your hand on the pulse of the bitcoin industry!